Why It’s Important to Update the Owner’s Name on Property Tax and Electricity Bills

When you purchase a property, registering the sale deed is just the beginning. A crucial but often overlooked step is updating the owner’s name on property tax records and electricity bills.

Many property owners skip this, thinking it’s a minor formality. However, keeping utility and tax records in your name is essential for legal, financial, and practical reasons. Neglecting this update can lead to delays, disputes, and even rejection of property-related services.

In this guide, we’ll explain why updating your name matters, the risks of not doing it, and how JaaGa can help you complete the process smoothly.

1. Legal Proof of Ownership

Property tax receipts and electricity bills are widely accepted as supporting evidence of ownership in legal cases.

- If the bills still carry the previous owner’s name, your ownership may be questioned in disputes or court proceedings.

- Updated utility records strengthen your legal position and make your ownership clear.

👉 Pro Tip: Courts, municipal bodies, and banks often demand these documents in your name as proof of possession.

2. Required for Property Resale & Home Loans

When you plan to sell your property or apply for a home loan, banks and buyers carefully verify ownership.

If your utility bills are outdated, it can:

- Delay the resale process

- Force you to provide additional documents

- Even result in rejection of the loan or sale

✅ Most banks insist on utility bills in the applicant’s name to avoid complications.

3. Smooth Mutation & Title Transfer

For mutation of property (updating ownership records with the municipal authority), your name must already appear in the property tax database.

Otherwise:

- Mutation may get delayed or rejected

- Extra documents like succession certificates may be required

- The process becomes time-consuming and stressful

Updating your tax records early ensures faster property services and hassle-free title transfers.

4. Eligibility for Government Schemes & Benefits

Many government schemes such as property regularization, subsidies, or compensation for development projects use utility and tax records to identify the rightful owner.

If your name isn’t updated:

- You may miss out on valuable schemes

- Applications may be rejected

- Authorities may consider you ineligible

5. Prevent Inheritance & Ownership Disputes

For inherited or gifted properties, leaving bills in the name of a deceased relative can create confusion later.

- Successors may face disputes during property division.

- Opportunistic parties may misuse outdated records to claim false ownership.

💡 Updating your records now saves your heirs from future legal battles.

✅ Final Thoughts

Updating your property tax records and electricity bills is not just paperwork it’s an investment in protecting your property.

Even though the sale deed remains the primary proof of ownership, supporting documents like utility bills are critical in practice for:

- Property resale

- Bank loans

- Mutation

- Legal disputes

- Government benefits

🏡 Need Help Updating Your Property Documents?

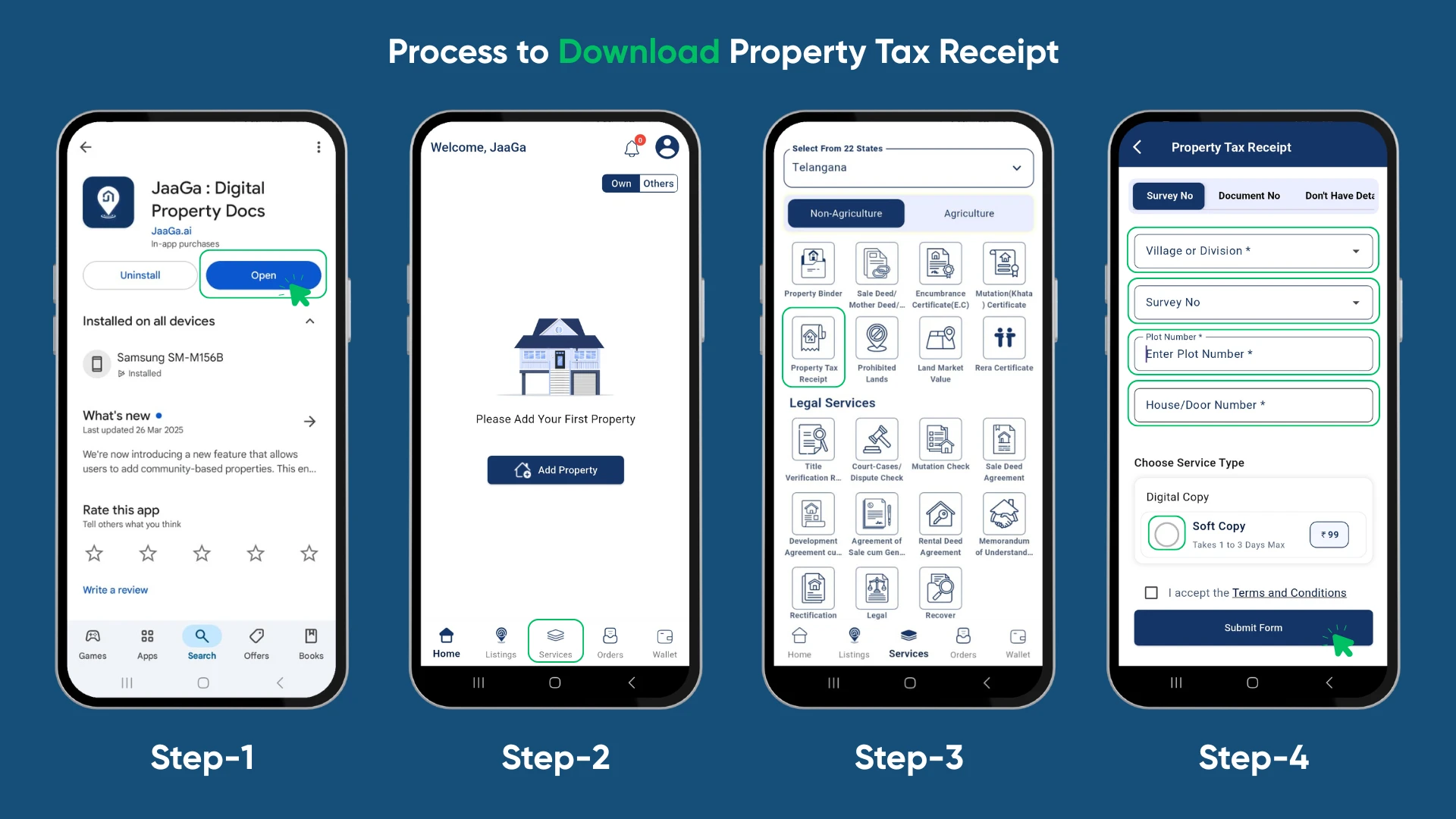

At JaaGa, we simplify the entire process. Whether you need to update property tax, electricity bills, or mutation records in Telangana or other regions, our experts ensure a fast and hassle-free experience.

📞 Book a Free Consultation: +91 88851 66880

🌐 Visit: www.jaaga.ai/services

📧 Email: social@jaaga.ai

👉 Don’t wait for issues to arise update your documents today and secure your property’s future.

.webp?updatedAt=1762412127043)