A Comprehensive Guide to Property Audits in India

Introduction to Property Audits in India

Investing in real estate in India is a significant financial decision. Whether you are buying, selling, or managing property, a property audit ensures that your investment is secure, legal, and compliant with government regulations. A property audit is a systematic examination of documents, legal status, and financial records associated with a property.

Property audits are essential for verifying ownership, checking for legal disputes, and confirming accurate taxation. Conducting an audit before buying or selling a property can prevent future legal and financial complications.

Why Property Audits Are Important

Property audits serve multiple purposes for homeowners, investors, and real estate developers:

- Legal Assurance: Ensures that the property has clear ownership and is free from litigation.

- Financial Security: Verifies the accuracy of property taxes, loans, and valuations.

- Transparency: Helps in identifying discrepancies in property records and documentation.

- Compliance: Ensures adherence to state and central property regulations.

- Peace of Mind: Reduces risks associated with purchasing or selling property.

In India, with the growing number of real estate disputes, a property audit acts as a preventive measure against fraud and loss.

Types of Property Audits

Property audits can vary depending on the purpose and scope. The main types include:

1. Legal Audit

A legal audit checks the property’s title, ownership documents, and encumbrances. This audit ensures that the property is free from disputes or illegal claims.

2. Financial Audit

Financial audits focus on the monetary aspects of the property, such as loan records, tax payments, rental income, and investment returns.

3. Technical Audit

Technical audits examine the physical aspects of the property, including construction quality, compliance with building codes, and land use approvals.

4. Environmental Audit

This audit assesses environmental compliance, such as pollution control measures, land contamination, and environmental impact clearance.

Steps Involved in a Property Audit

A property audit involves multiple stages to ensure thorough verification. The key steps are:

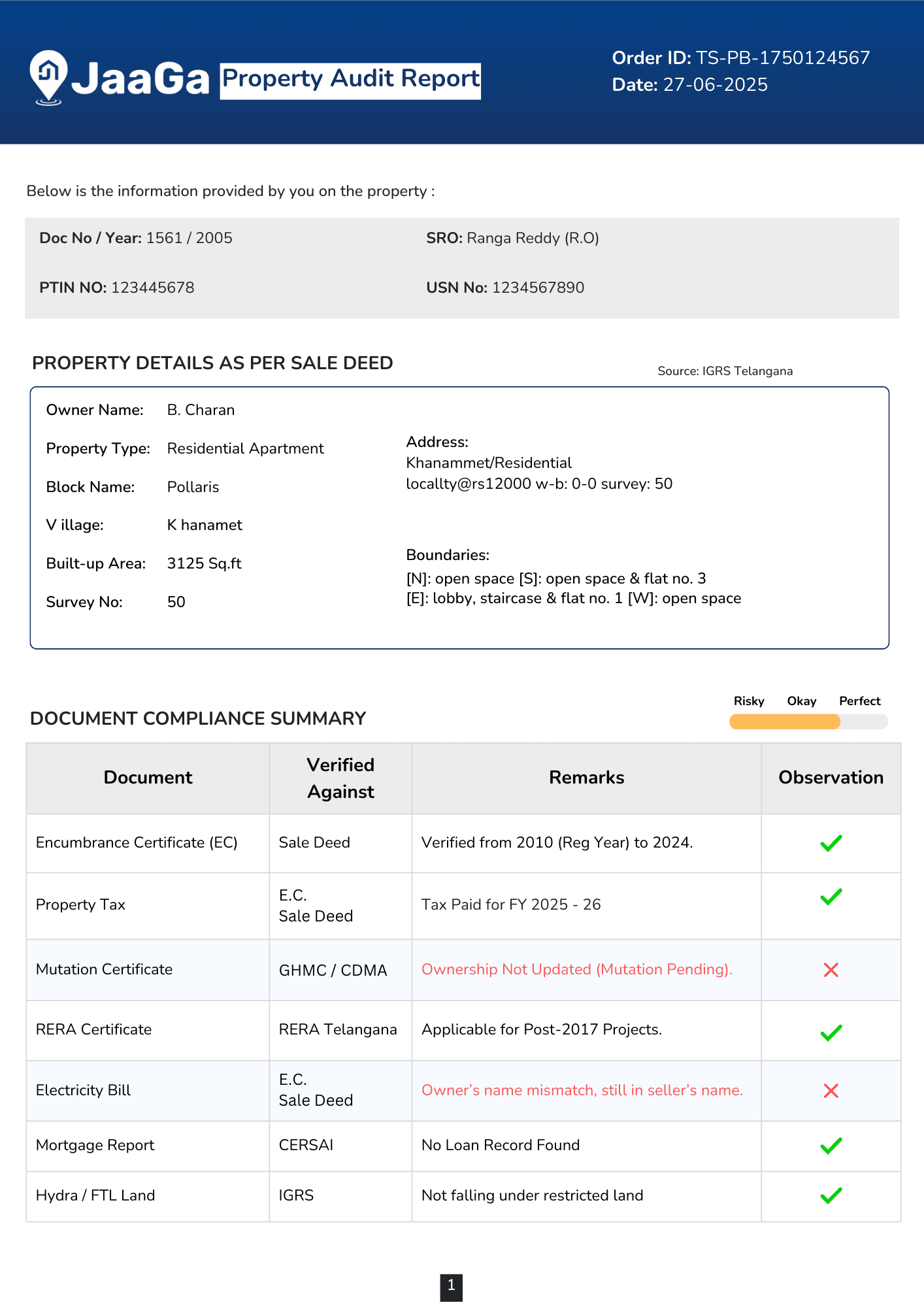

- Document Verification: Collect and verify all legal documents, including: Sale deed, Title deed, Property tax receipts, Encumbrance certificate, No-objection certificates (NOCs), Approved building plan

- Legal Status Check: Verify the ownership of the property and check for pending disputes, mortgages, or encumbrances with local authorities or courts.

- Physical Inspection: Inspect the property to confirm the land area, boundary limits, and quality of construction against approved plans.

- Financial Audit: Examine tax records, utility bills, outstanding loans, and rental agreements to ensure transparency in financial dealings.

- Regulatory Compliance: Check compliance with local municipal, environmental, and zoning regulations to avoid legal complications in the future.

- Audit Report: Prepare a comprehensive report highlighting all findings, discrepancies, and recommendations for corrective action.

Legal Documents Required for Property Audit in India

A successful property audit requires specific legal documents:

- Sale Deed: Confirms ownership transfer.

- Title Deed: Establishes legal ownership of the property.

- Encumbrance Certificate: Ensures property is free from legal liabilities.

- Property Tax Receipts: Confirms taxes are up-to-date.

- Approved Building Plan: Validates construction compliance.

- Occupancy Certificate: Confirms property is fit for occupation.

- No-Objection Certificates (NOCs): From relevant authorities or lenders.

Ensuring all these documents are authentic is crucial for a credible audit.

Benefits of Conducting a Property Audit

- Fraud Prevention: Avoid falling victim to property scams.

- Smooth Transactions: Facilitates easier property buying, selling, or leasing.

- Accurate Valuation: Ensures correct market value of the property.

- Legal Security: Reduces the risk of ownership disputes and court cases.

- Financial Clarity: Provides transparency in taxes, loans, and investments.

Common Property Audit Challenges in India

- Incomplete Documentation: Missing or fake documents can delay audits.

- Disputed Titles: Ownership conflicts require legal intervention.

- Regulatory Complexities: Varying state laws make audits complex.

- Encumbrances and Mortgages: Outstanding liabilities need verification.

- Physical Discrepancies: Construction or land size may not match official records.

Addressing these challenges is crucial for a smooth audit process.

Role of Professionals in Property Audits

Engaging qualified professionals ensures a comprehensive and accurate property audit:

- Legal Experts: Verify ownership, title deeds, and encumbrances.

- Chartered Accountants: Audit financial records and taxation.

- Surveyors: Conduct physical and technical inspections.

- Real Estate Consultants: Provide market insights and valuation.

Professional audits save time, reduce risk, and ensure compliance with legal requirements.

Digital Property Audit in India

With technology advancement, digital audits are becoming popular. Many states now allow online verification of property documents and tax payments. Digital audits offer:

- Faster document verification

- Reduced human error

- Transparent record keeping

- Easy access to historical property records

Online platforms can also generate encumbrance certificates, property tax receipts, and NOCs digitally, making audits more efficient.

FAQs About Property Audits in India

1. What is a property audit?

A property audit is a detailed verification of a property’s legal, financial, and physical status to ensure ownership clarity and compliance with regulations.

2. Who can conduct a property audit?

Legal experts, chartered accountants, surveyors, and certified property auditors can conduct audits professionally.

3. How long does a property audit take?

Typically, audits can take from a few days to several weeks, depending on property size, location, and complexity of documentation.

4. What documents are required for property audit?

Sale deed, title deed, encumbrance certificate, property tax receipts, NOCs, approved building plans, and occupancy certificates.

5. Is property audit mandatory in India?

While not mandatory for all cases, property audits are highly recommended to prevent disputes and ensure legal and financial security.

6. Can digital property audits replace physical verification?

Digital audits simplify document verification but may still require physical inspection for construction quality and boundary checks.

Conclusion

Property audits in India are an essential step for anyone dealing with real estate, whether for investment, buying, or selling. They ensure transparency, prevent disputes, and provide a legal and financial safety net.

By understanding the process, types, and benefits of property audits, property owners and investors can make informed decisions and secure their investments. Professional audits, combined with digital verification tools, make property audits more accessible, accurate, and reliable than ever before.

.webp?updatedAt=1762412127043)