How to Download Property Tax Receipt in Telangana Using JaaGa App: A Complete Guide

If you're a property owner in Telangana, paying your property tax every year is your legal duty. But paying isn’t enough. You also need the Property Tax Receipt for records, property loans, or during resale. The good news? With the JaaGa App, you can download your Telangana property tax receipt online in just a few taps!

This guide explains how to get your receipt using the JaaGa App quickly, without visiting the municipal office or standing in long queues.

What is a Property Tax Receipt?

A Property Tax Receipt is an official document that proves you have paid your property tax for the financial year. It typically includes:

- Your name and property address.

- Assessment number, also known as the PTIN (Property Tax Identification Number).

- The tax amount paid and the date of payment.

- A unique transaction ID or reference number.

Why is this receipt important?

- Proof of Ownership: It acts as supporting evidence of property ownership.

- Legal Compliance: It shows that you are compliant with local tax laws.

- Loans & Resale: It's a mandatory document for home loan applications, and during the sale or transfer of property.

- Record Keeping: Essential for maintaining accurate property records.

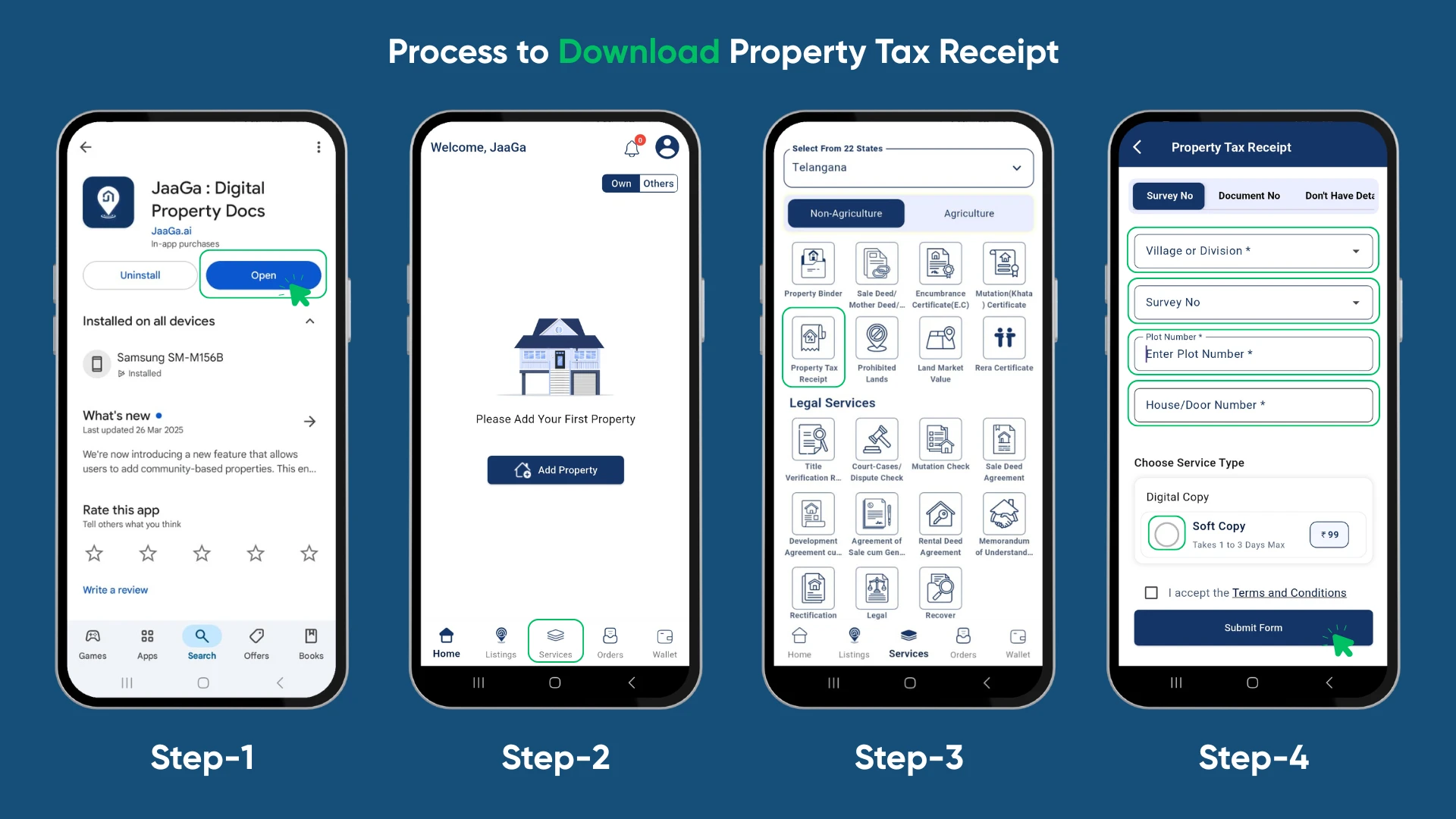

📲 Steps to Download Your Property Tax Receipt with the JaaGa App

Step 1: Install the JaaGa App

- Go to the Google Play Store or the Apple App Store.

- Search for “JaaGa: Digital Property Docs”.

- Tap "Install" and open the app.

Step 2: Login or Sign Up

- Enter your mobile number and verify it using the OTP sent to your phone.

- If you already have an account, you can simply log in.

Step 3: Navigate to the "Services" Section

- Select Telangana as your state.

- On the home screen, tap on the “Property Tax” service.

Step 4: Enter Your Property Details

- Select your "Village / Division".

- Enter your "Survey No.", "Plot No.", and "House Door No.".

- Alternatively, if you have your Property Tax Identification Number (PTIN), you can use it to get your receipt instantly.

- Verify that the property details displayed on the screen are correct.

Step 5: Download the Receipt

- Once the system fetches your payment history, your receipt will be available.

- You will receive the official PDF receipt issued by GHMC or your respective municipal body.

🏙️ Which Municipalities are Supported in Telangana?

JaaGa supports property tax services for a growing list of areas, including:

- Greater Hyderabad Municipal Corporation (GHMC)

- Warangal Municipal Corporation

- Karimnagar, Nizamabad, Khammam, and other Urban Local Bodies (ULBs) in Telangana

💡 Why Use JaaGa for Telangana Property Tax Receipts?

- Convenience: Works for all major Telangana cities, right from your phone.

- Time-Saving: No need to visit MeeSeva centers or municipal offices.

- Instant Access: Get an instant PDF download of your official receipt.

- Secure & Verified: Data is fetched directly from secure government APIs.

- All-in-One: Also offers other property document services like certified copies, EC, sale deeds, and land records.

🔐 Is JaaGa Safe to Use?

Yes! The JaaGa app uses official government APIs and follows strict security protocols. All data is fetched directly from official Telangana government sources, such as the CDMA Telangana and GHMC portals, ensuring the information is authentic and up-to-date.

🤔 What If I Don’t Know My PTIN?

No worries! JaaGa can help you find your PTIN using your name, house number, and locality. Just tap on the “Don’t Have Details?” option and follow the simple steps inside the app.

📢 Final Words

For property owners in Telangana, downloading a Property Tax Receipt has never been easier. With the JaaGa App, you can access your receipts in seconds, securely, online, and without any hassle.